Claiming Back Tax at the Airport for International Purchases

Shopping during international trips is often one of the highlights of travel. Many tourists enjoy finding products that are either unavailable or more affordable than at home. What some travellers may not know is that it is possible to receive a refund on the taxes paid for many of these purchases. Known as a VAT or GST refund depending on the country, this benefit allows non-residents to recover part of their spending before leaving the country.

The process can be simple if you are prepared and follow a few key steps. Here is what you need to understand about claiming tax money at the airport for goods bought abroad.

Understanding Tax Refunds for Travellers

Most countries include a consumption tax in the price of goods and services. This tax is paid by residents of that country. As a tourist, however, you are considered a non-resident and are often not required to pay this tax on products you are taking home with you. This applies mainly to physical goods and not to services like meals or hotels.

To qualify, you must shop at stores that offer tax-free purchases. These stores will provide specific documents or receipts that are required for a refund claim. In most cases, there is a minimum spending amount required per store, and purchases must be made within a specific time before your departure.

What to Do Before Heading to the Airport

Being organised before your departure is key to getting your refund. First, when you make a purchase, ask the shop assistant if tax-free shopping is available and request the necessary refund paperwork. You may need to show your passport to prove your visitor status.

Keep all receipts and make sure the information matches your travel documents. Some forms may need to be signed or filled in before your departure date. If you are travelling with several people, each person must submit their own paperwork for individual claims.

At the Airport: Where and How to Claim

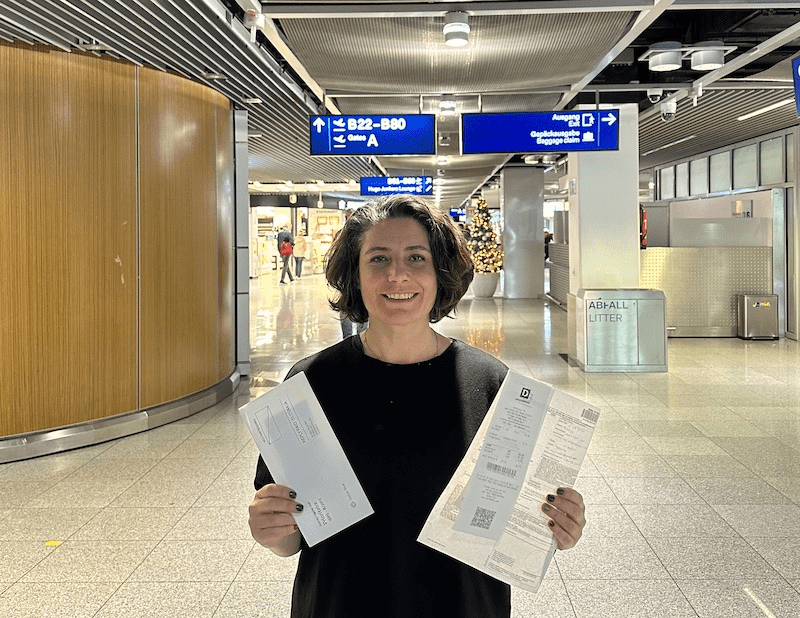

When you arrive at the airport, find the customs office or tax refund area before checking in your luggage. In most cases, you must show the goods you purchased along with the receipts and refund forms. If the items are packed away or used, your claim may be denied. After inspection, the customs official will stamp your paperwork, which confirms your eligibility for a refund.

Next, take the stamped documents to the refund counter or designated refund agency. Many large airports have a clear process for this, often with multilingual staff to assist. Depending on the location, you may receive the refund in local currency, have it transferred to your credit card, or receive a cheque or bank transfer later.

Some airports offer self-service kiosks that speed up the process. These are especially common in major European destinations and allow you to complete part of the process electronically.

Common Mistakes to Avoid

One of the most frequent issues is checking in your luggage before the customs inspection. Since customs officers often need to verify the goods, make sure to keep them in your carry-on or accessible suitcase.

Another mistake is waiting too long at the airport. Refund queues can be long, especially during busy seasons, so allow plenty of time before your flight. Also, be sure that all your forms are properly filled out, and the names on your receipts match your passport.

Why It Is Worth Taking the Time

Even though the process involves paperwork and a few extra steps, the savings can be significant. VAT rates in many countries range from 10 to 25 percent, which adds up quickly if you have made high-value purchases. Items like clothing, accessories, electronics, and luxury goods are all commonly included.

Getting a refund is a straightforward way to reduce your total travel expenses. It also gives you more flexibility to shop confidently while abroad, knowing that some of the price you pay can be recovered later.

Final Thoughts

Claiming back tax at the airport for goods bought abroad is a smart practice that benefits travellers who plan ahead. The key is to keep receipts, understand the local rules, and allow enough time at the airport to complete the refund process. By doing so, you can return home with not only new purchases but also a little extra cash in your pocket.